Overview

Paying and filing business taxes through Digital Banking is simple and secure. This guide walks you through the process and answers common questions to help you file with confidence.

To pay your business taxes:

|

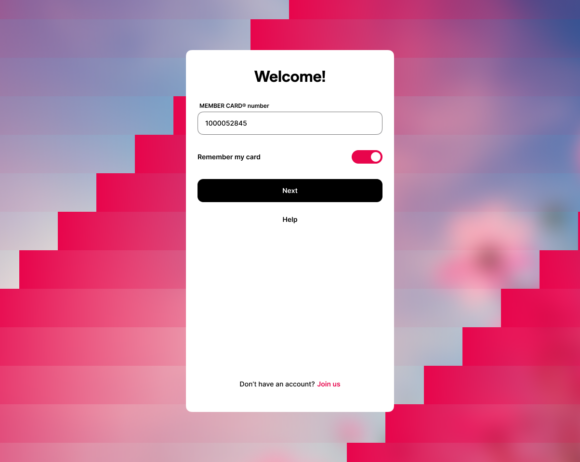

Step 1:

Sign in to Digital Banking. |

|

Step 2:

From Bills, select Pay business tax. |

|

Step 3:

Choose the CRA filing type (e.g., GST/HST, Payroll, Corporation Tax). |

|

Step 4:

Enter your CRA Business Number for the selected tax type. Review your details, confirm the amount, and submit your payment. Tip: Save your confirmation number for your records. |

Use the CRA Business Number that matches the tax type you’re filing (for example, your GST/HST number).

The GST/HST 34 remittance form automatically calculates key fields based on your inputs:

- Line 109: Net Tax

- Line 115: Payment Enclosed

- Line 114: Rebate Claimed

These fields cannot be changed manually.

CRA offers a working copy to help you prepare:

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/calculate-prepare-report.html

Tip: For any tax-related questions, consult a tax professional.

No. Both Retail and Small Business members can use the Pay Business Taxes feature in Digital Banking.

CRA filings and payments are processed between 10:30 a.m. and midnight PST. If you submit outside these times, your transaction may take longer to appear.

No. The confirmation number only shows that your request was submitted—it’s not proof of payment.

To confirm, check your Account Activity and verify with CRA through:

https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html